Litter arising from plastic bags. The existing plastic bag levy will increase from the current rate of 22c to 25c.

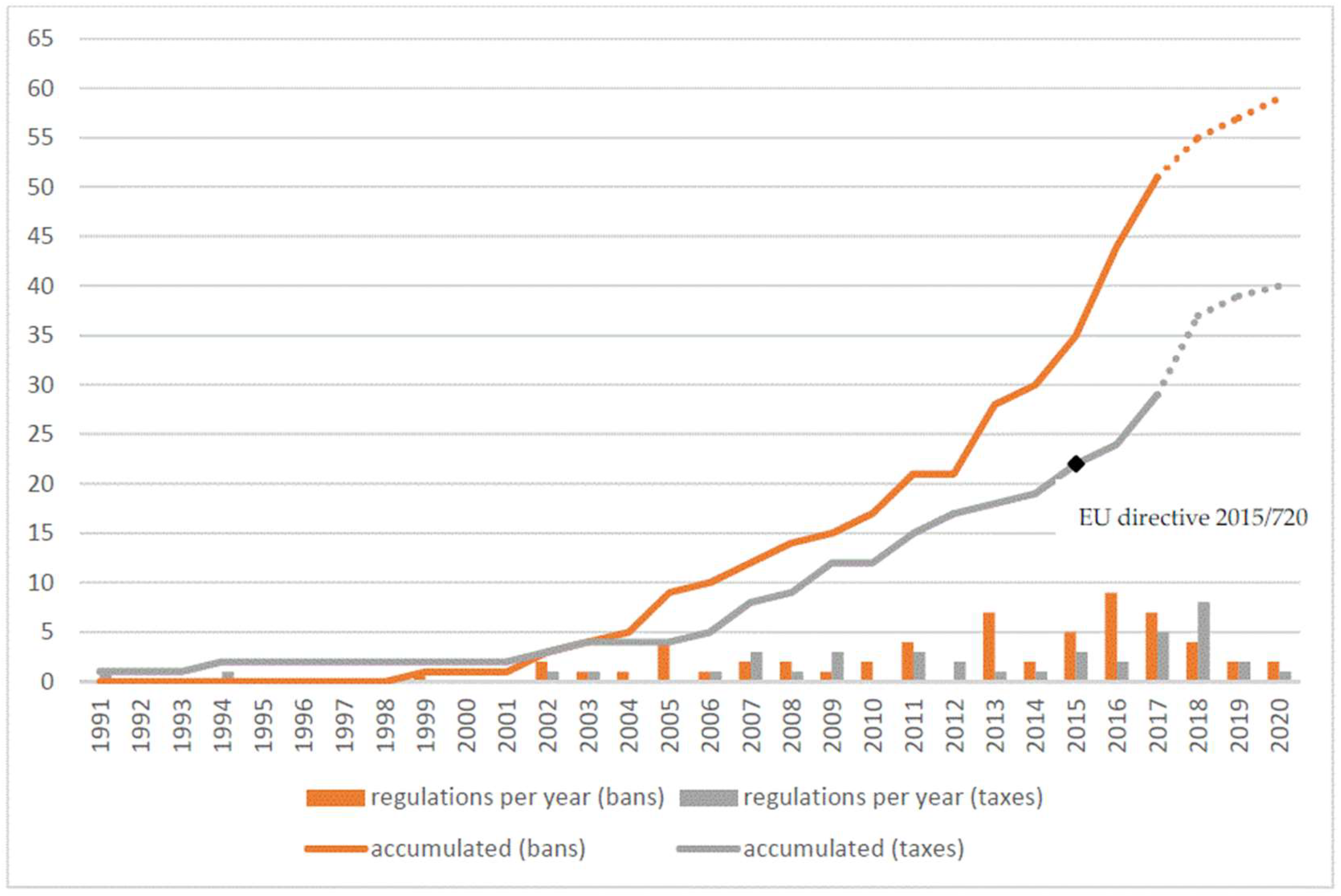

Timing And Number Of Global Plastic Bag And Microbead Interventions In Download Scientific Diagram

The retailer is obliged to itemise the levy on cash register receipts given to the customer.

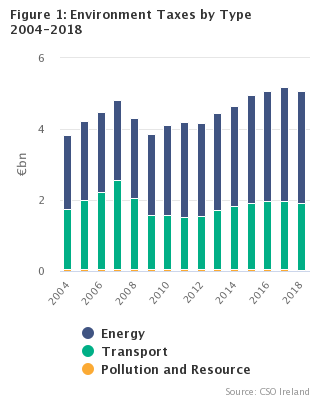

. Plastic bag consumption increased alarmingly in Ireland in the 1990s. Plastic and papercardboard showed the largest increases. NACE Sector Analysis Table 2 shows environment taxes by.

To achieve these new recycling targets waste plastic packaging recycling in Ireland will have to increase to circa 175824 tonnes by 2030. A record of plastic bags supplied to customers where the levy applies 3. It is an environmental levy on plastic shopping bags.

The Plastic Bag Levy Since the 4th March 2002 a levy called the Environmental Levy has applied to the supply of plastic shopping bags by retailers. The levy is charged at 22 cent per bag. Ensure that a charge of 22 cent is applied to each plastic bag sold.

Retailers who supply plastic bags to customers must charge a levy to customers at the point of sale. In 2002 Ireland became the first country to impose a plastic bag levy. A record of plastic bag purchases.

Plastic Bag Levy increase from 22c to 25c. Since its introduction on 4 th March 2002 the plastic bag levy had an immediate effect on consumer behaviour with plastic bag per capita usage decreasing overnight from an estimated 328 bags to 21. Increase in the Landfill Levy by 5 per tonne to 80 per tonne.

This 36 of recycled plastic represents the equivalent of 4912 40ft shipping containers of plastic material. There are exceptions for bags of certain sizes and for bags which contain fresh fruit unpackaged vegetables meats and certain other products. Currently the levy is 22 cent per shopping bag.

As the primary purpose of the plastic bag levy is to prevent littering the levy also applies to bio-degradable plastic bags. The levy is currently 22 cents per plastic bag and must be charged to consumers by retailers at point of sale. It was estimated that some 12 billion plastic shopping bags were provided free of charge to customers in retail outlets annually before the introduction of the levy.

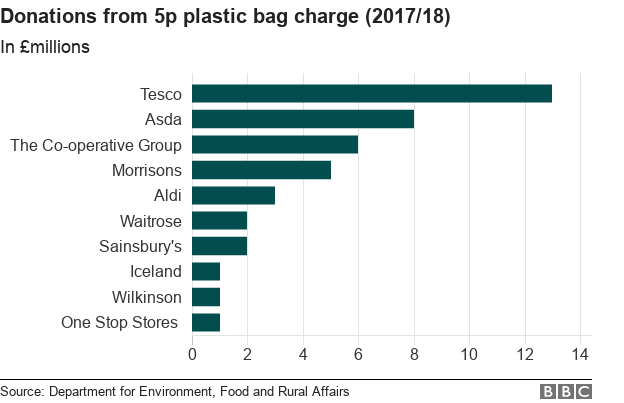

August 2004 - 022. In its annual report on the policy it also revealed that 935 million carrier bags were dispensed in 201819 a 53 million drop from 201718. This increase is contained within SI.

Retailers then pay this levy to Revenue. Keep records of. Ireland produced 1124917 tonnes of packaging waste in 2019 an increase of 11 on 2018.

The levy was introduced as an anti-litter measure aimed at reducing the use of disposable plastic bags which accounted for 5 of Irelands litter and had a highly visible impact on the. 167 of 2007 - Waste Management Environmental Plastic Bag Levy - Amendment No. In 2018 the Plastic bag and Landfill levies were 9 million and 17 million respectively.

The introduction of a plastic bag levy had an immediate benefit to our environment with a decrease in excess of 95 in plastic bag litter. It had an immediate effect when introduced in 2002 on consumer behaviour with a decrease in plastic bag usage from an estimated 328 bags per capita to an estimated 14. The Government also plans to introduce a levy on take away food containers by 2023 and on food packaging in retail outlets at a yet to be determined date.

Revenue collects the levy on behalf of the Department of Communications Climate Action and Environment. When a customer requests a plastic bag the retailer must generally charge 022 per plastic bag supplied. The new tax on plastic bags has been a spectacular overnight success and is set to cut out over 90 per cent of the States consumption of the.

The current plastic bag levy is 22c. The levy is remitted into the Environment Fund. The levy must be itemised on any invoice till receipt or.

A decrease in excess of 95 in plastic bag litter. Irelands leading environmental coalition welcomes the Social Democrats inclusion of a levy on single-use and non-recyclable plastics in the partys pre-Budget submission. A discarded plastic bag.

The plastic bags usually cost about 5 15 cents. Background to the Plastic bag Levy. The opening stock take of plastic bags from when the levy was increased.

Tonnes of waste plastic packaging generated in Ireland. This had an immediate benefit to our environment. In 2002 Ireland introduced a plastic bag levy at a rate of EUR 015 per bag which increased to EUR 022 per bag from 2007.

Plastic Bag Litter in Ireland -prior to the 5 levy - was high. Make a quarterly payment to the Revenue Commissioners. The use of plastic bags in Northern Ireland has dropped by 688 since the introduction of a 5p levy on their distribution in 2013 according to new figures from Northern Irelands environmental department.

The retailers are responsible for maintaining records on the 1 Verified through. It is imposed at point of sale on the supply by retailers of plastic shopping bags to customers. Get up to date with the latest news and stories about the event plastic bag levy at The Irish Times.

Surveys indicated that up to 90 of shoppers used long-life bags in 2003 compared with 36 in 1999. December 2002 - 032. Launched this morning the partys submission states that the two environmental levies would bring in 2 million in revenue while also helping reduce the use of plastics across society.

August 2003 - 025. It led to a 90 drop in use of plastic bags with one billion fewer bags used and it generated 96 million for a green fund supporting environmental projects. The introduction of the levy in March 2002 led to a dramatic reduction in the number of disposable plastic bags supplied to consumers from an estimated 328 bags per person per year prior to the introduction of the levy to 21 bags per person by the end of 2002 and a further reduction to an estimated 8 bags per person by the end of 2016.

5 per tonne Waste Recovery Levy for incineration and waste exports. In addition there is much less roadside litter from plastic bags. The generally upward trend in packaging waste generation in Ireland since 2013 shows that Ireland is failing to decouple economic activity from waste generation Figure 1.

The levy was increased to the maximum of 22 cent allowable under the existing legislation. The plastic bag levys primary purpose is to reduce the consumption of disposable plastic bags by influencing consumer behaviour. The plastic bag levy currently 22 cents per leviable bag was introduced primarily as an anti-litter measure designed to influence consumers by encouraging them to reduce their use of disposable plastic bags.

Sustainability Free Full Text Developing Countries In The Lead What Drives The Diffusion Of Plastic Bag Policies Html

Projected Waste Generation Of Plastic Bags 2000 2020 Download Scientific Diagram

Plastic Bag Tax Hotsell 56 Off Www Hcb Cat

Timing And Number Of Global Plastic Bag And Microbead Interventions In Download Scientific Diagram

Efficacy Of Plastic Shopping Bag Tax As A Governance Tool Lessons For South Africa From Irish And Danish Success Stories

0 comments

Post a Comment